Anti-Money Laundering Policy

Following the introduction of Italian Legislative Decree 90/2017, which amended Italian Legislative Decree 231/2007, the obligations deriving from the legislation governing anti-money laundering and terrorist financing apply not only to financial intermediaries and professionals, but also to Investees of Public Administrations and their subsidiaries.

AdB's Board of Directors approved the Anti-Money Laundering Policy and identified the Ethics and Anti-Corruption Committee as the internal body receiving the information flows and which is responsible for evaluating cases of actual risk, based on the selected anomaly indicators, and for sending communications to the relevant entities through the SOS manager, identified as the Head of Legal and Corporate Affairs and Procurement. In fact, the Company is obligated to promptly inform the UIF (financial information unit) of data and information concerning transactions in relation to which it suspects or has reasonable grounds to suspect that money-laundering or terrorist financing is being or has been carried out or attempted or that, in any case, the funds, regardless of their size, come from criminal activity.

The Policy defines the guidelines for managing the risks of money laundering and terrorist financing at the Company, taking account of the legislative and regulatory provisions in force and the industry best practices.

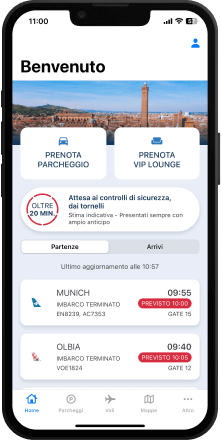

Useful guidance for users with electronic toll payment devices

If you purchase online with credit/debit cards or Satispay, you will have guaranteed access to the car park. If you prefer to pay with Telepass or UnipolMove, you cannot purchase parking online and access will only be subject to parking space availability.

Buy online

Electronic toll payment device not available

On-site purchase